foreign gift tax india

Do you have to pay tax on money given as gift on Cash. To make the most of such a provision one needs to find out more about it in detail.

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

Under the existing provisions of the Act a gift of money or property is taxed in the hands of donee except for certain exemptions provided in clause x of sub-section 2 of section 56.

. If the gift amount exceeds US 14000 your friend in the US would have to pay the gift tax there and you would have to pay the income tax on the excess amount above Rs. Not being an individual is Indian resident during the year of gift. Gift tax in India Conclusion.

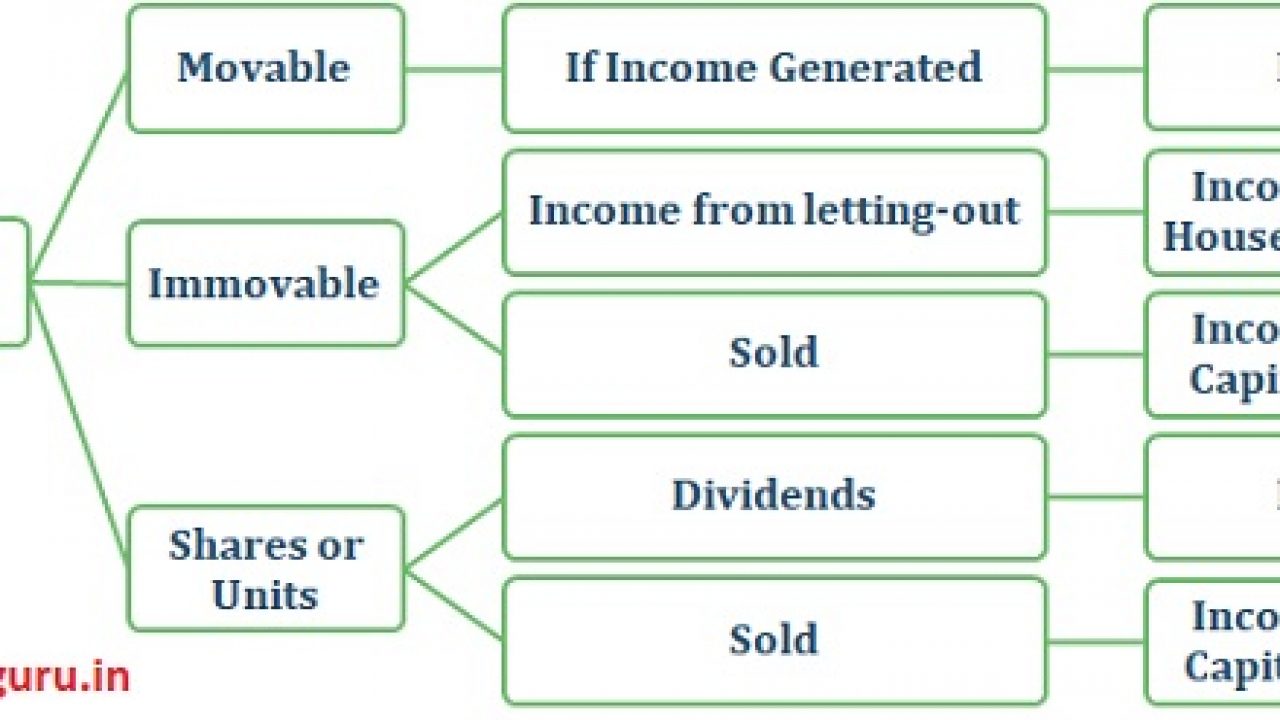

200000 and the consideration is Rs. FMV of such property. Gift tax on movable property received.

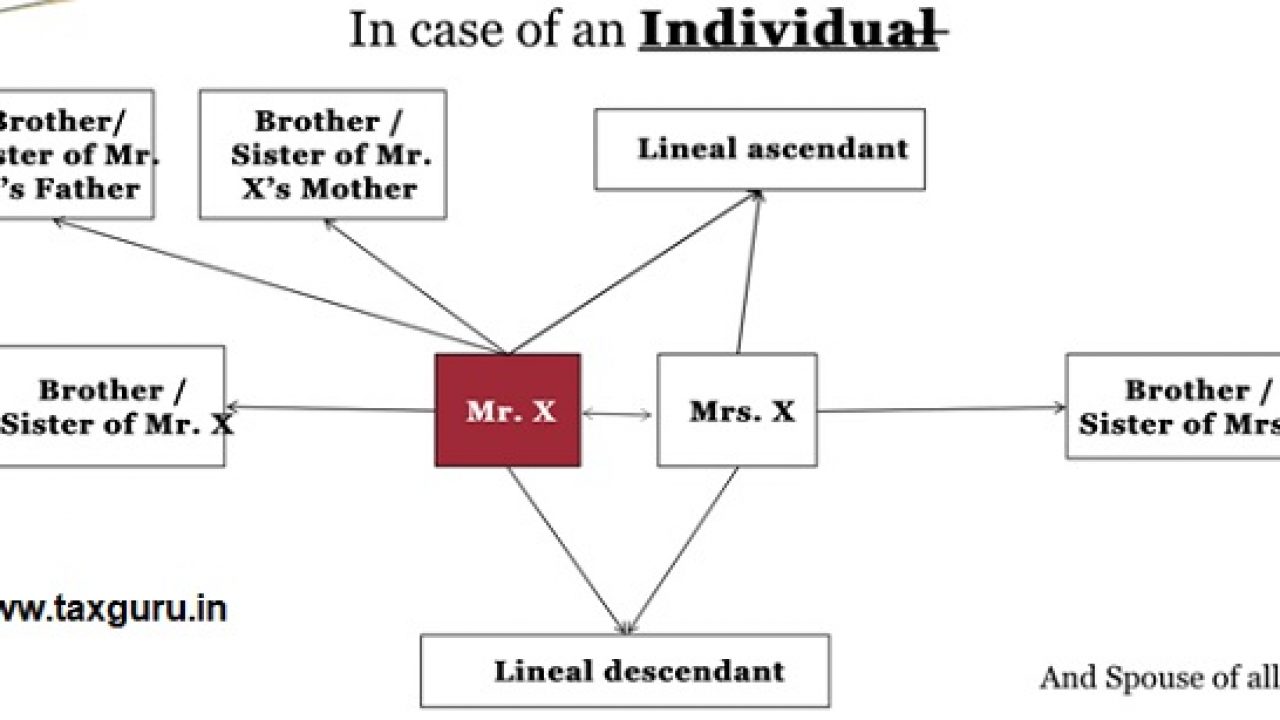

In addition gifts from specific relatives like parents spouse and siblings are also exempt from tax. NRIs will need to disclose such gifts and pay the tax as per the tax rules. Population consists of immigrants.

Frequently Asked Questions 1. Accordingly gift tax does not apply. International Tax Gap Series.

For instance if you are sending money from the united states to india the new tax is not applicable. When a resident Indian gives gifts in the form of cash cheque items or property that exceeds the value of Rs. Youd have to add the excess Rs.

One must remember that there are certain exceptions in tax on gifts in India. Also when an immovable property is received for an inadequate consideration whereby the difference between the consideration and the propertys stamp duty value exceeds the higher of Rs. Gifts of movable properties outside India unless the donor-.

Approximately 135 percent of the current US. In the current case the Indian parents are not US persons and are not liable for US tax. In Example 1 if consideration is Rs 280000 taxable gift amount is Nil as stamp duty value does not exceed consideration by Rs 50000.

Foreign gift tax india. So if you are receiving more than Rs. The amount is added to the receivers income and taxed as per the income tax slab applicable to the receiver.

In accordance with the legislation as it stands now that was piled in 2017 talent obtained by any individual by any individual or persons are residing in the hands of the receiver under the head income from other sources at normal tax prices. Following gifts made by any person are exempt from tax. The Gift Tax was introduced in India in 1958 but gift tax in India is now coming under the Income Tax Act.

However nothing will be charged to tax if the aggregate amount of gift received during the year does not exceed Rs. The process of setting up of a new company or llp in gift city would be subject to regulation 7 of the foreign exchange. The new TCS rules will apply on gifts to NRIs if it exceeds Rs 7 lakh.

Gift tax in India Process. Essentially gifts here represent anything in the form of cash bank cheques demand drafts and. Gifts up to Rs 50000 per annum are exempt from tax in India.

Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958 was repealed in 1998. Any property jewelry shares drawings etc other than immovable property without consideration. Being an individual is a citizen of India and is ordinarily a resident of India or.

50000 or 5 of consideration then such difference is taxable in the hands of the recipient as gift tax. Of course with such a spotlight on ensuring that all government demands and requirements are met. Gifts in other cases are taxable.

As a US person you are required to report any gift or bequest from a foreign person if it exceeds USD 100000 in. Gifts of immovable properties situated outside India. 650000 to your income and pay tax on it.

Fair market value FMV Rs 50000. Suppose the stamp duty is Rs. Now amendment has been introduced in budget 2019 to ensure that such gifts made by residents to persons outside India are subjected to tax in India.

When it comes to sending remittances as gifts to NRI according to the taxation rules on gifts since July 2019 TDS is applicable if the value of the gifts exceeds Rs 50000 in a financial year. The principles pertaining to gift tax. As a result there is an increasing demand for information about the correct handling of tax situations involving Green Card holders and legal and illegal residents such as foreign gift tax.

Person other than an organization described in section 501c and exempt from tax under section 501a who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts and file the form by the. The list of prescribed occasion on which gift is not charged to tax and hence gift received from friends will be charged to tax. In such a case the taxable amount will be stamp duty minus the consideration value ie.

50000 in a year from anybody other than your relatives please remember there is a tax on that gift. 50000 to an NRI who is a non-relative the India gift tax NRIis payable by the receiver. India Post Payments Bank DA News Today PM Kisan eKYC Last date NSDL Speed-e Mobile App Trading Account PM Kisan Scheme Benefits Home Loan Interest Rates Gold Loan Rates Personal Loans Rates Axis Bank Fd Interest Rates Holika Dahan Holiday Pan Aadhaar Link Aadhaar Card Download Holi Bank Holiday Bank Holidays in March 2022 Income Tax Slab for.

The Taxation Laws Amendment Act 2006 further lays down that if the cash receipts from several parties exceeded Rs 50000 per year the whole of the aggregate value of the gift will be brought to tax as income. If you are a US.

Gift Deed Drafting Registration Stamp Duty Tax Implication Faq In 2021 Legal Services Legal Advice Gifts

Selling Gifted Property In India 5 Important Things You Should Know In Filing Itr This Year Income Tax Return Income Tax Paying Taxes

Supply And Scope Consultants Corporate Bonds Investing Investment Companies

Taxation Of Gifts Received In Cash Or Kind

Foreign Venture Capital Investors And Related Regulations Http Rplg Co 6c82cf00 Income Tax Return Indirect Tax Income Tax

Brand Identity Pack For Japanese Tax Accounting Firm By Beyondesign Accounting Firms Retail Design Logo Templates

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Tax Structure In India Apna Gyaan

Yes Reserve Bank Has Granted General Permission To Foreign Citizens Of Indian Origin To Acquire Or Dispose Of Properties Up To The Originals Citizen Ahmedabad

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Capital Gains Tax Freelance

Sending Gifts To Children Relatives Abroad You May Have To Pay Tax The Financial Express

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Taxability Of Gifts Some Interesting Issues

Monthly Corporate Due Dates Calendar 2018 Simple Tax India Due Date Calendar Due Date Calendar 2018

What S The Difference Between An Nro Account And An Nre Quora Accounting Helpful Hints Dividend Income

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable